There are many types of tax incentives provided by Malaysian Government to attract foreign or local investors for investment in certain industries in Malaysia.

The tax incentives are provided in forms of exemption of profits, allowance for capital expenditure or double deduction of expenses.

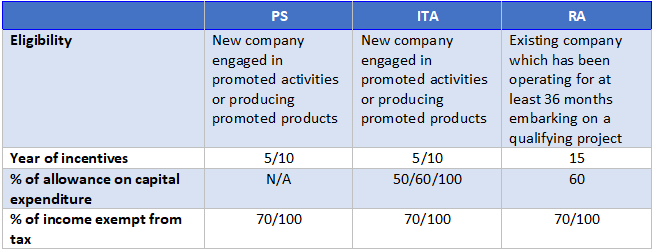

In this article, we will explain the main three types of tax incentives available for industries in Malaysia, which are Pioneer Status (PS) and Investment Tax Allowance (ITA) which are available under Promotion of Investment Act 1986, and Reinvestment Allowance (RA) which is provided under Income Tax Act 1967. These three incentives are mutually exclusive, that is to say only one incentive is available to a company at one time.

Pioneer Status (PS)

The PS incentive is given in the form of direct exemption of profit from the payment of income tax for a period of 5 years (certain companies are given 10 years) up to 70% (certain companies enjoy 100%) of a company’s statutory income (income after deduction of allowable expenses and capital allowances). The period of tax exemption commences from the “production date” as determined by the Minister of International Trade and Industry (MITI).

In the event that a PS company makes losses during the pioneer period, the unutilised losses and capital allowances may be carried forward to the post-pioneer period for set off against future business income of the company. The unabsorbed pioneer losses available as at the end of the pioneer period are allowed to be carried forward up to a maximum of 7 consecutive years of assessment only.

The PS is available to companies engaged in promoted activities or producing promoted products. The Malaysian Investment Development Authority (MIDA) has prepared a long list of activities and manufactured products as “promoted activities” and “promoted products”. The list of promoted products and activities is under constant review and is updated from time to time to bring the list in line with Government’s investment policies. Please visit MIDA’s website at http://www.mida.gov.my for a full list of promoted products and activities.

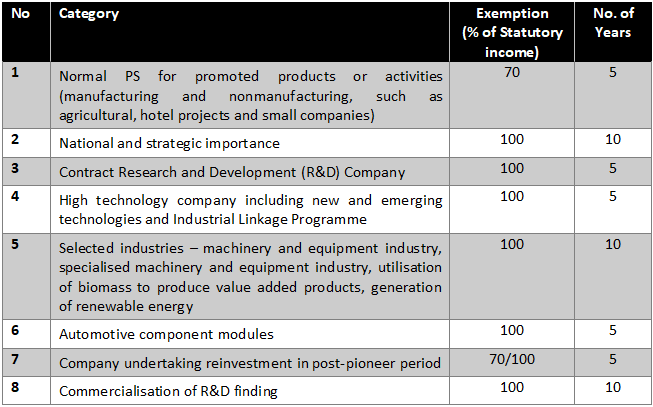

Broadly, there are 8 categories of PS in the Promotion of Investments Act 1986 (PIA) as follows:

The 10-years tax relief period indicated above would be granted for an initial 5 years period and would be extended by another 5 years when the relevant conditions are fulfilled.

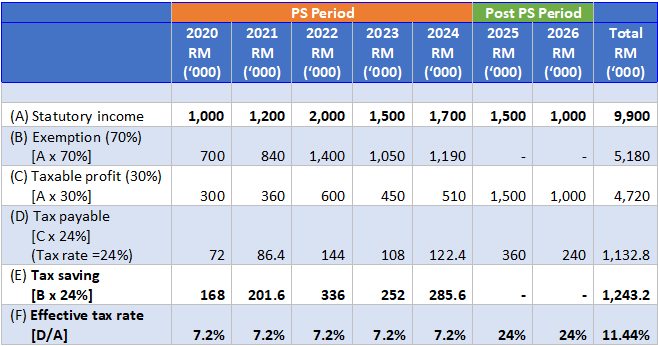

Example 1

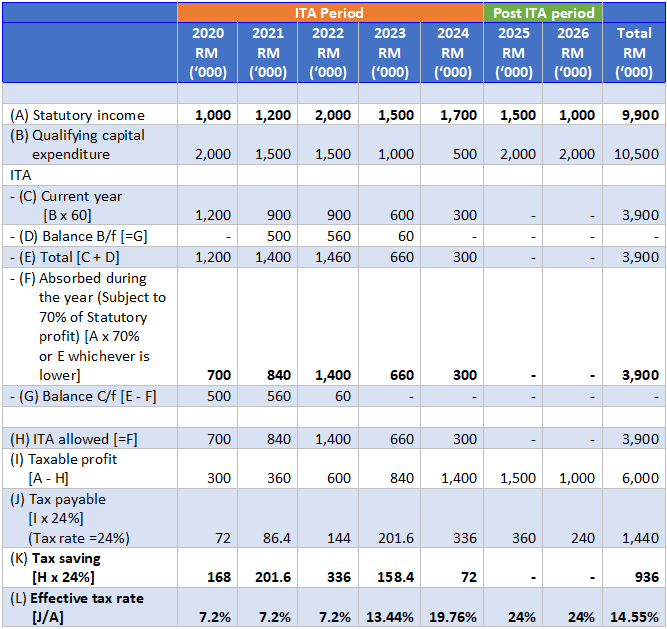

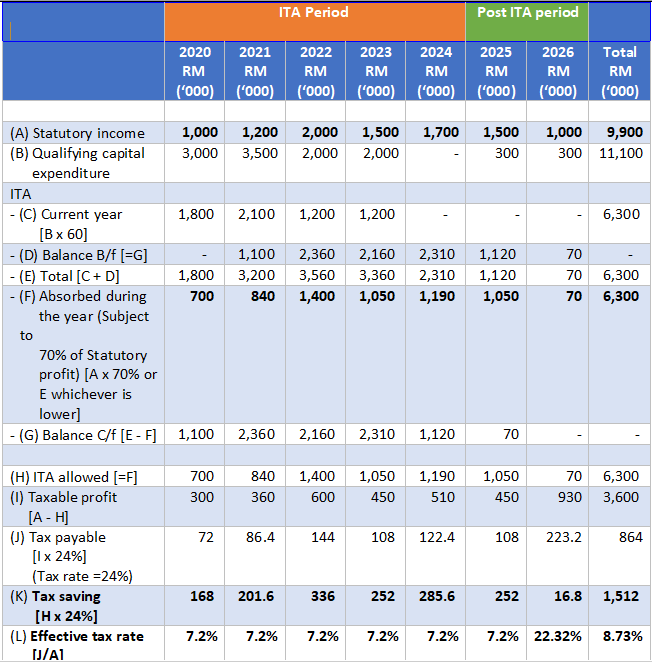

ABC Manufacturing Sdn Bhd (ABC) has been granted PS with 70% profit exemption on 1-1-2020 for a period of five years. The financial year end of ABC is 31 December. Statutory profit for year 2020, 2021, 2022, 2023 and 2024 are RM1,000,000, RM1,200,000, RM2,000,000, RM 1,500,000 and RM1,700,000 respectively. The exemption and tax payable for ABC will be as follow:

Investment Tax Allowance (ITA)

The ITA incentive is an alternative incentive to PS. The ITA incentive is preferable over the PS incentive for projects which are capital intensive and which are not expected to generate large profits in a short time. Similar to PS, ITA is available to companies involved in promoted activities or promoted products.

The tax incentive given under ITA is in the form of allowance (in addition to the capital allowance) on qualifying plant and equipment acquired by the company during the ITA period (i.e. tax relief period). The normal rate of allowance is 60% on the qualifying capital expenditure and can be offset up to 70% of the statutory income of the company. A 100% ITA may be claimed and utilised to reduce 100% of the statutory income of a company for certain promoted products or promoted activities. Any unused ITA in a year can be carried forward to future years.

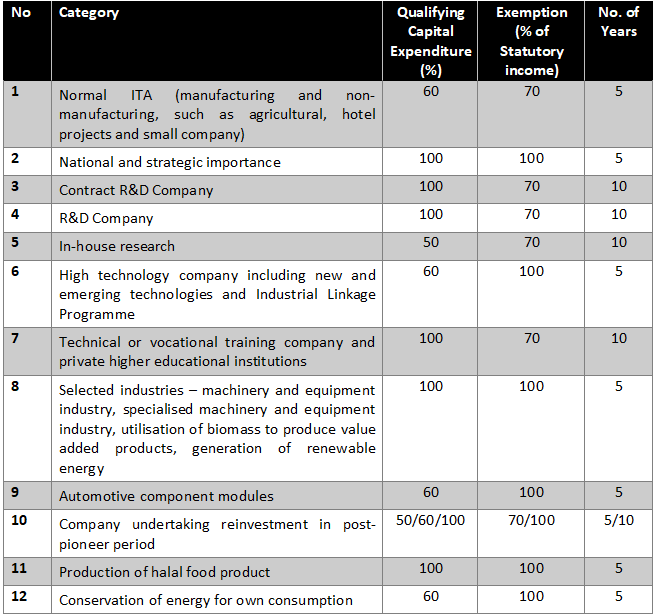

Any unutilised ITA during the ITA period can be carried forward for set off against the future business income in the post ITA period. The unabsorbed ITA available as at the end of ITA period is allowed to be carried forward up to a maximum of 7 consecutive years of assessment only. Broadly, there are 12 categories of ITA in the PIA as follows:

The 10-years tax relief period as stated above would be granted for an initial 5-year period which would be extendable by another 5 years when the relevant conditions are fulfilled.

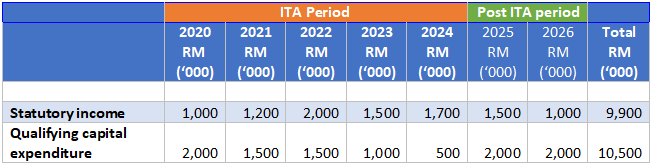

Example 2

DEF Manufacturing Sdn Bhd (DEF) has been granted ITA with 60% of ITA and 70% profit exemption on 1-1-2020 for a period of five years. The financial year end of DEF is 31 December. Statutory profit and capital expenditure incurred are as follow:

The ITA and tax payable are as follow:

Note: The qualifying capital incurred in 2025 and 2026 are not eligible for ITA as they are incurred post ITA period.

Example 3

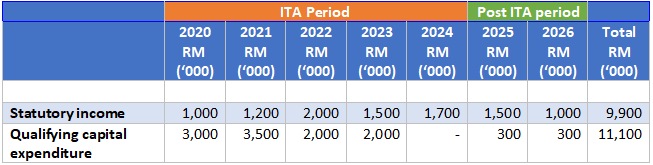

GHI Manufacturing Sdn Bhd (GHI) has been granted ITA with 60% of ITA and 70% profit exemption on 1-1-2020 for a period of five years. The financial year end of GHI is 31 December. Statutory profit and capital expenditure incurred are as follow:

The ITA and tax payable are as follow:

Note : The qualifying capital incurred in 2025 and 2026 are not eligible for ITA as they are incurred post ITA period, whereas the balance of unclaimed ITA as at the end of 2024 is allowed to be claimed after the ITA period until fully claimed (Subject to a maximum of 7 consecutive years).

Based on the Example 1, 2 and 3 above, you will notice that if the capital expenditure is lower as per Example 2, the tax saving will be lower for ITA compare to PS. On the other hand, if the capital expenditure is greater as per Example 3, it will be more beneficial to choose ITA as the tax saving is higher compare to PS.

Reinvestment Allowance (RA)

RA, an incentive granted under Schedule 7A of the Income Tax Act 1967, is available to manufacturing companies that reinvest their capital to embark on a qualifying project for either expansion of existing production capacity, modernisation or automation of the production facilities, or diversification into related products. RA is also available to companies engaged in agricultural projects (e.g. cultivation of rice, maize, fruits, vegetables, tubers and roots, livestock farming, spawning, breeding or culturing aquatic products, etc.). RA will only be available for companies which have been in operations for at least 36 months.

Similar to ITA, the tax incentive given for RA is in the form of allowance (in addition to the capital allowance) on qualifying plant and equipment acquired by the company during the RA period. The rate of RA is 60% on the qualifying capital expenditure. The RA is used to reduce up to 70% of statutory income of the company from its business source in respect of the qualifying project. Any unused RA may be carried forward for set off against the future business income in the post RA period. The unutilised RA as at the end of the RA period are allowed to be carried forward up to a maximum period of 7 consecutive years of assessment only. A company can claim RA up to 100% of its statutory income in a particular year of assessment if it could demonstrate that the level of process efficiency ratio exceeds the industrial average for the year.

The incentive period for RA is 15 years from the first year of claim by a company. Unlike PS or ITA, this incentive does not require prior approval from any of the authorities. RA incentive cannot be claimed in the same basis period if a company is also enjoying PS or ITA incentives.

The calculation of RA will be similar to ITA. Please refer to Example 2 and 3 for detail calculation.

A summary of the differences between PS, ITA and RA are as follows:

Conclusion

Income tax is an important factor that needs to be taken into consideration in the planning of investment in Malaysia as this will affect the return on investment and, if not properly plan, can have a significant negative impact on the return. Among the various types of tax incentive available, upon making decision, investor should 1) looks for the types of tax incentives available; 2) do the projection of profit amount of the investment; and 3) do the projection of capital expenditure amount for the investment for a minimum period of 5 years.

CHAI Meng Ka FCCA, CA(M), ACTIM

Founder

IPM Group